Investment Support/Due Diligence/Risk Assessment

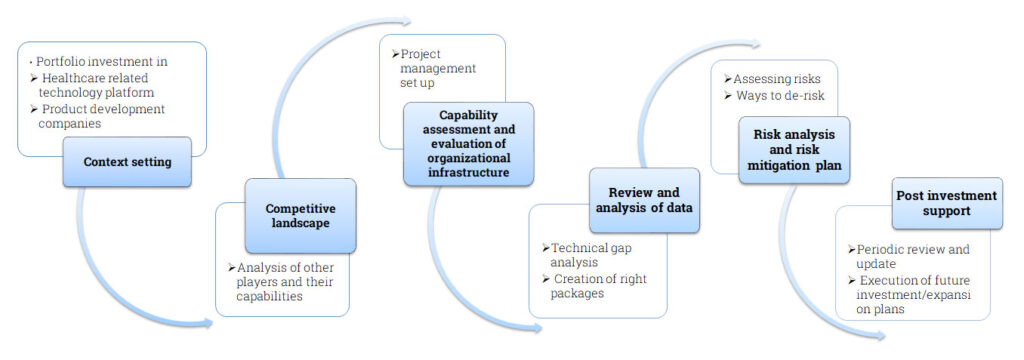

For our Investors, we perform Competitive landscape (technical), Technical assessment and feasibility, Gap Analysis, Capability assessment of the organization & evaluation of infrastructure along with Risk analysis and Risk mitigation plan. We also offer post investment support which includes Periodic review and update, Raising red flags, if any, and Future investment/expansion plans.

For our Technology based/ Product Development companies, we perform technical gap analysis, creation of RIGHT packages and reach out to investment bankers

Enabling market impacting collaborations

Advent International, one of the largest and most experienced global private equity investors, had signed an agreement to acquire a majority interest in Bharat Serums and Vaccines Limited, a biopharmaceutical leader in women’s healthcare, assisted reproductive treatment, critical care and emergency medicine in India and emerging markets. This investment would strengthen and expand Bharat Serums’ offerings in India and global markets. Advent has been investing in India since 2007. During this time, it has deployed more than $1.5 billion in 11 companies with headquarters or operations in the country. Transaction is Advent’s seventh investment in the healthcare sector and fifth investment in India in 2019. IBPS did a technical evaluation of the company’s portfolio and pipeline to enable this investment successfully. IBPS Consulting is proud to have assisted Advent International in this major development in the Pharma and Biopharma Industry in India.